There is an angel conspiracy.

It dark, it is devious, and it is far-reaching.

The conspirators number amongst them many of the top people in the Valley, including angels, VCs, lawyers, and yes, even journalists.

We have joined together despite our differences and conflicts for a single, sinister, self-interested purpose.

To get your attention.

— Angel Investor/Entrepeneur Chris Yeh, on VentureBeat and Adventures in Capitalism

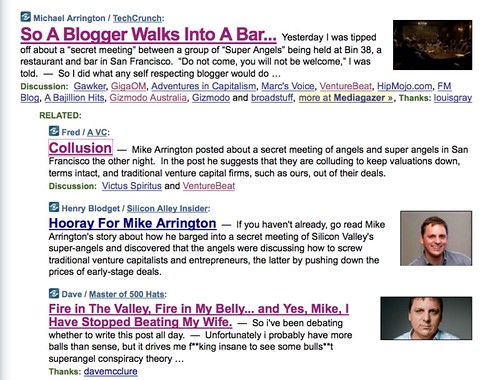

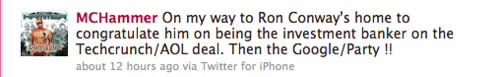

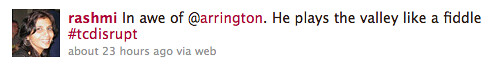

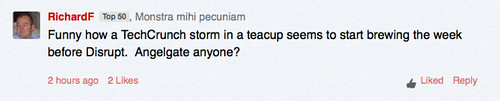

Maybe Michael Arrington of TechCrunch really did stumble into a conspiracy of “collusion and price-fixing”, with Silicon Valley super-angels conspiring in SF’s trendy Bin 38 to fend of the threat of Y-Combinator, drive down valuations, and push VCs out of the picture. Then again maybe he’s just stirring things up prior to next week’s TechCrunch Disrupt VC/Super-angel smackdown.

Sarah Jacobsson Purewal covers it well on PC World; Rosa Goligan’s got a three-paragraph summary Shady Meetings, Unlawful Acts, and One Ballsy Blogger in Gizmodo.

Yeah really. Mathew Ingram’s got a roundup on GigaOm quoting Chris, Dave, Bryce, Fred, Ryan, Andrew, and Mark.  Techmeme’s got links to most of them as well as Henry, Marc, Chris, Mathew, Ashkan, Alex, Alan, Stowe, Dean and Mark — see the comments for a screenshot. And On Google, I found links to Patricio, John, Mike, Chris, Ben, Dan, and Gautham … hey wait a second, I’m noticing a pattern here.

The valley boys are hanging out on Quora, too (along with a few women), speculating on the identity of the so-called “super angels”. Likely suspects include Ron, Brian, Dave, Jeff, Mike, Aydin, Steve, Bryce, and Sundeep (who tweeted from the “secret” meeting). Bryce joins in the comments on Quora, where he’s joined by Danny, Henry, Ben, and several anonymous users — one of whom comments that Keith, Joshua, Jason, and Thomas have all denied being that the meeting.* The Hacker News discussion’s good too, although no reaction to the Y Combinator angle.

On A VC, Fred Wilson makes some good points about the increased likelihood of investor collusion in an angel environment. Of course as Marc Canter points out in I’m Shocked, I tell You, Shocked!, Fred does deals with all these guys, so it’s scarcely surprising he doesn’t see it as collusion,** but it’s still worth listening to his conclusion:

The very fact that some of the most active and respected angels in silicon valley were meeting to discuss the changing dynamic of their business suggests to me that the opposite is happening. I suspect that the good old days when they could all get together and do a deal are gone. And they are not happy about what they see happening to their market.

Indeed. In fact I think there are three different things going on here. The most obvious the continued trend towards more funding options, especially on the low end: including Kickstarter as well as incubators like Y Combinator. Diaspora has to be one of the hottest angel-size startups right now, and they raised $150K without having to go to angels. This pushes angels to larger and later deals and into more collisions with VCs, so they need to adapt.

Indeed. In fact I think there are three different things going on here. The most obvious the continued trend towards more funding options, especially on the low end: including Kickstarter as well as incubators like Y Combinator. Diaspora has to be one of the hottest angel-size startups right now, and they raised $150K without having to go to angels. This pushes angels to larger and later deals and into more collisions with VCs, so they need to adapt.

Geography is another important dimension of what’s happening. Angel investors as well as VCs have traditionally had very strong local networks — which has been great for Silicon Valley investors, because theirs has been the most valuable network.  Now other credible tech hubs have emerged in the US (New York, Boulder, Seattle, Boston …) and internationally with enough startup infrastructure and valuable networks in their own right. Especially with the state of California in such a mess, Silicon Valley’s advantages are rapidly decreasing.

And as if that’s not enough …

The valley boys may not see it as discrimination, but the overwhelmingly male VC and angel community has given most of the money and attention and power to guys like themselves, many of whom go on to become the next generation of VCs, angels, and journalists. Now women are unlocking the clubhouse as everybody realizes, d’oh, that’s the majority of the population who spend most of the money and have better results as CEOs. Patterns for successful angel and VC investment need to change, and it’s particularly a challenge for groups whose networks are overwhelmingly male. Y Combinator’s 92%-male investments may not be a threat here, but they’re not the only game in town.

So yes, there’s a lot of pressure on the Silicon Valley angels, and it’s not surprising for them to meet privately without any press when their interests are under threat. Since so many of them are friends and colleagues it’s scarcely surprising that they’d get together and talk about it over dinner  Some people may have crossed the line and done something illegal, and if so hopefully they’ll be caught. Other kinds of collusion are as old as the hills, legal, and unlikely to go away.**

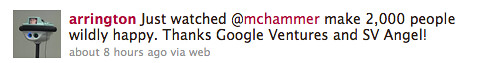

Still, what a great lead-in to TechCrunch Disrupt! As well as a Super Angel vs. VC smackdown with several of these guys, there are also fireside chats with several male investors and an all-woman panel on women in technology.

This year’s theme is “the third wave,” which I think will make a great lens to look at the conference. Stay tuned for more …

jon

PS: Updated throughout the day, most recently at 4:30 p.m.

* In case anybody’s wondering, I wasn’t there either

** September 24: Mark Suster has a great discussion of this in What Entrepreneurs Should Do About Price-Fixing on Both Sides Now

Originally titled “Collusion is such an ugly word”, an obscure reference to an old Firesign Theater routine. So it’s fishpaste, is it? The revised title is from a tweet by Sasha Pasulka, aka evilbeet, author of Too Few Women in Tech? Stop Telling People How They Should Feel About It, and used with permission. Thanks, Sasha! Thanks also to Kara for the decoding and further discussion on Twitter, and to Stephanie for the timely reminder

MG Siegler, in

MG Siegler, in

We have a winner!

We have a winner!

Here’s my summary of the Angelgate panel, in a comment on

Here’s my summary of the Angelgate panel, in a comment on

“Arrington basically threatened the assembled entrepeneurs,” says a source who was there.

“Arrington basically threatened the assembled entrepeneurs,” says a source who was there. First, my initial reaction when I first heard about the deal: Ugh. Sigh. Hopelessly corrupt. Now 100 percent more icky! A giant, greedy, Silicon Valley pig pile….

First, my initial reaction when I first heard about the deal: Ugh. Sigh. Hopelessly corrupt. Now 100 percent more icky! A giant, greedy, Silicon Valley pig pile….

Leave a Reply